This post was originally published on this site

Editor’s note: This is a recurring post, regularly updated with new information and offers.

I associate premium credit cards with luxury travel perks and hefty annual fees. Many of these cards offer solid value, especially if you’re loyal to the underlying brand.

There are two long-standing titans of the premium card market: [applyLink pid=”22504813″ overridetext=”The Platinum Card® from American Express”] and the [applyLink pid=”221211836″ overridetext=”Chase Sapphire Reserve®”] (see [termsConditions pid=”221211836″ overridetext=”rates and fees”]). The former built the market for premium rewards cards decades ago, while the latter has grown its mass appeal in under a decade since launching in 2016.

Since the Chase Sapphire Reserve was just overhauled with new benefits and a higher annual fee, it’s a good time to compare it to the Amex Platinum, a card that’ll soon receive its own set of changes.

The battle for these two cards has never been fiercer, so let’s examine whether the refreshed Sapphire Reserve deserves a place in your wallet or if you should opt for the Amex Platinum instead.

Related: Best travel credit cards

Amex Platinum vs. Sapphire Reserve comparison

| Card | Amex Platinum | Sapphire Reserve |

| Welcome offer | Find out your offer and see if you are eligible to earn as high as 175,000 bonus points after spending $8,000 on purchases within the first six months of card membership. Welcome offers vary, and you may not be eligible for an offer. | Earn 100,000 bonus points and a $500 Chase Travel℠ credit* after spending $5,000 on purchases in the first three months from account opening. |

| Annual fee | $695 (see [termsConditions pid=”22504813″ overridetext=”rates and fees”]) | $795 |

| Earning rates |

|

|

| Notable benefits |

|

|

*The Chase Travel credit is a one-time credit for new Sapphire Reserve cardholders. Any unused portion from the first eligible transaction will be forfeited.

**Enrollment is required, and terms apply.

Amex Platinum vs. Sapphire Reserve welcome offer

When considering a new premium credit card with a $600-plus annual fee, you’ll want to make sure you start off right with a large welcome offer that helps you recoup the hefty annual fee right away.

For the [applyLink pid=”22504813″ overridetext=”Amex Platinum”], find out your offer and see if you are eligible to earn as high as 175,000 bonus points after spending $8,000 on purchases within the first six months of card membership. Welcome offers vary, and you may not be eligible for an offer.

This has the potential to be a highly lucrative welcome offer because, according to TPG’s June 2025 valuations, American Express Membership Rewards points are worth 2 cents each, potentially making the welcome offer worth up to $3,500.

Just know that Amex only allows you to earn a welcome offer once per lifetime, so if you aren’t targeted for the highest offer, it may be worth holding off until you are.

Meanwhile, the [applyLink pid=”221211836″ overridetext=”Sapphire Reserve”]’s welcome offer allows new cardholders to earn 100,000 bonus points and a $500 Chase Travel credit after spending $5,000 on purchases in the first three months from account opening.

We haven’t seen this high of a welcome offer since the card was initially released in 2016. This elevated welcome offer is thanks, in part, to the recent changes made to the card.

If you are a current cardholder of the [applyLink pid=”22125056″ overridetext=”Chase Sapphire Preferred® Card”] (see [termsConditions pid=”22125056″ overridetext=”rates and fees”]) or previously earned a welcome bonus on the Sapphire Reserve, you almost certainly will not be eligible for a second bonus. If you fall into this category, it’s best to apply for the Amex Platinum instead.

TPG’s June 2025 valuations peg Chase Ultimate Rewards points at 2.05 cents each, making this bonus worth $2,550, including the $500 Chase Travel credit. This welcome bonus is easier to attain thanks to its slightly lower spending requirement than the Amex Platinum’s welcome offer.

Winner: Tie. If you’re targeted Amex Platinum offer is more than 100,000 bonus points, then go for it; otherwise, the Chase Sapphire Reserve is a better choice.

Related: The best credit card welcome bonuses

Amex Platinum vs. Sapphire Reserve benefits

The [applyLink pid=”221211836″ overridetext=”Chase Sapphire Reserve”] and the [applyLink pid=”22504813″ overridetext=”Amex Platinum”] are the two most expensive credit cards in the marketplace. Thanks to a refresh, the Sapphire Reserve now holds the title of the most expensive premium credit card with an annual fee of $795, slightly higher than the Amex Platinum’s $695 annual fee.

Despite such high annual fees, you’ll find each card provides benefits that help you recoup more than what you’re paying. The Sapphire Reserve offers the following statement credits:

- $500 annual hotel credit: $500 annual statement credit for hotels booked through The Edit by Chase Travel (up to $250 biannually)

- $300 annual travel credit: Flexible $300 annual travel credit for purchases; eligible purchases include airfare, prepaid car rental bookings, hotel stays, mass transit, tolls and parking meters

- Expedited traveler program credit: Up to $120 statement credit for a Global Entry, TSA PreCheck or Nexus application every four years

- Entertainment credit: $300 annual statement credit for StubHub or Viagogo purchases through Dec. 31, 2027 (up to $150 biannually)

- Apple TV+/Apple Music membership credit: Up to a $250 value; you’ll receive complimentary memberships for Apple TV+ and Apple Music through June 22, 2027 (a one-time activation is required per service)

- Dining credit: $300 annual dining credit at Sapphire Reserve Exclusive Tables (up to $150 biannually)

- Peloton credit: $120 in annual statement credits toward Peloton memberships (through Dec. 31, 2027)

- DoorDash credit: Complimentary DoorDash DashPass subscription worth up to $120 annually (activate by Dec. 31, 2027) and up to $25 in DoorDash promos each month while you have an active DashPass subscription

- Lyft credit: $10 monthly credit in-app (does not apply to Wait & Save, bike or scooter rides; through Sept. 30, 2027)

As a Sapphire Reserve cardholder, you’ll also receive complimentary IHG One Rewards Platinum Elite status. You can unlock Diamond Elite status with $75,000 in spending on your card during a calendar year.

Additional spend-incentivized perks, including a $250 Shops at Chase credit, Southwest Rapid Rewards A-List status and a $500 Southwest Airlines credit when booking through Chase Travel, are also available after spending $75,000 in a calendar year.

It’s important to note that these benefits are available immediately to cardholders who open their accounts after June 23. For existing cardholders, they will be available starting Oct. 26. The exceptions to this rule are the $300 travel credit, the DoorDash promos and the Lyft in-app credit.

Lounge access perks include a Priority Pass Select membership and access to Chase Sapphire Lounge by The Club locations, with the ability to bring up to two guests. Cardholders also get access to select Maple Leaf Lounges and Air Canada Cafes in Canada, the U.S. and Europe when departing on a Star Alliance member airline flight.

Additionally, the Sapphire Reserve comes with its industry-leading travel protections:

- Primary car rental insurance

- Baggage delay insurance

- Trip delay insurance

- Trip cancellation/interruption insurance

- An emergency medical and dental benefit

The Amex Platinum has its own fair share of benefits, including substantially more statement credits. These include:

- Up to $200 in statement credits per calendar year for incidental fees charged by one eligible airline you select***

- Up to a $200 annual hotel credit per calendar year, in the form of a statement credit, on prepaid Amex Fine Hotels + Resorts or The Hotel Collection bookings made within the Amex Travel portal when you pay with your Amex Platinum (Hotel Collection stays require a two-night minimum)***

- Up to $200 in Uber Cash per calendar year, valid on Uber rides and Uber Eats orders in the U.S., split into monthly up to $15 credits, plus an up to $20 bonus in December*** (Uber Cash will only be deposited into one Uber account when you add the Amex Platinum as a payment method and redeem with any Amex card)

- Up to $199 in statement credits per calendar year to cover your Clear Plus annual membership***

- Up to $240 per calendar year in annual digital entertainment credit split up as up to $20 monthly statement credits with eligible merchants***

- Up to $300 in Equinox credit per calendar year for Equinox gym and Equinox+ app memberships (subject to auto-renewal)***

- Up to $300 in statement credits per calendar year toward the purchase of a SoulCycle bike (up to 15 bikes per calendar year); must be enrolled in an Equinox+ membership to be eligible for this benefit

- Up to a $155 statement credit per calendar year (up to $12.95 monthly, plus applicable taxes) to cover the cost of a monthly Walmart+ membership (on one membership, subject to auto-renewal; Plus Up excluded)

- A $120 statement credit for Global Entry every four years or an up to $85 fee credit for TSA PreCheck every 4 1/2 years (depending on which application fee is charged to your card first)

- Up to $100 per calendar year in Saks Fifth Avenue credit split into two up to $50 statement credits (one between January and June, then another from July through December)***

Terms apply to the benefits listed.

Amex Platinum’s lounge access is well revered. It includes the American Express Global Lounge Collection, including Centurion Lounges, Priority Pass lounges, Aspire lounges, Escape Lounges, Plaza Premium lounges and Delta Sky Clubs (when traveling on same-day Delta Air Lines flights; eligible Platinum Card members will receive 10 visits per eligible Platinum Card, per year to the Delta Sky Club or to a grab-and-go location when traveling on a same-day Delta-operated flight).***

Additional perks include complimentary Gold status with Hilton Honors and Marriott Bonvoy*** and the following complimentary car rental status: Hertz Gold Plus Rewards President’s Circle, Avis Preferred Plus and National Emerald Club Executive.***

Travel and purchase protections include trip delay****, trip cancellation and interruption insurance****, extended warranty***** and purchase protection.***** Terms apply to these benefits.

***Enrollment is required for select benefits.

****Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by New Hampshire Insurance Company, an AIG Company.

*****Eligibility and benefit levels vary by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. Policies are underwritten by AMEX Assurance Company.

The most challenging aspect of these titans is unpacking the benefits and seeing how they compete with one another. As a cardmember of both cards, I find tremendous value in both of them; however, with the Sapphire Reserve’s latest changes, the card may have the upper hand over the Amex Platinum.

When objectively comparing the benefits, I’d say the Sapphire Reserve’s statement credits are easily maximized and probably applicable to most people. The Amex Platinum simply cannot compete with the Sapphire Reserve’s flexible $300 travel credit, especially when compared to the card’s restrictive $200 airline credit.

The Sapphire Reserve offers a higher annual hotel credit than the Amex Platinum, and the Sapphire Reserve’s dining credit for use at Sapphire Reserve Exclusive Tables restaurants appears pretty straightforward to redeem. It requires no reservation; you simply pay at a participating restaurant with your Sapphire Reserve.

It goes without saying that the Amex Platinum has more lifestyle credits, but a lot of these credits don’t mean much to every cardmember, and people simply use them or go out of their way to use them because the card offers them. Otherwise, these benefits generally aren’t on their radar.

For example, if you do not have an Equinox gym in your vicinity or a need for an Equinox+ app, the $300 credit is not useful. I do not have a need for a Walmart+ membership; however, since the Amex Platinum fully covers it, I signed up. Otherwise, it’s a perk I could live without.

As an Amex Platinum Card member, you receive much more comprehensive lounge access, but the inability to bring guests to Centurion Lounges (without spending $75,000 in a calendar year) is overshadowed by the Sapphire Reserve, which allows up to two free guests to its Sapphire lounges.

The Amex Platinum’s Uber credit is much more flexible since it allows you to use it for Uber Eats, and the card’s offering of elite status with Hilton, Marriott and several car rental companies is something the Sapphire Reserve cannot compete with.

Chase has historically been the leader in travel insurance, as its offerings have generous terms. Amex has partially closed the gap, adding a suite of travel protection benefits to the Amex Platinum Card.

Winner: Sapphire Reserve. It offers statement credits that are easier for most to maximize, along with leading travel protections.

Related: How to decide if a credit card’s annual fee is worth paying

Earning points on the Amex Platinum vs. Sapphire Reserve

Although the welcome bonus is a good way to start your points balance, you want a card that’ll help you quickly rack up valuable transferable points.

The [applyLink pid=”22504813″ overridetext=”Amex Platinum”] earns:

- 5 points per dollar spent on airfare purchased directly with airlines or through Amex Travel (on up to $500,000 of airfare purchases per calendar year, then 1 point per dollar)

- 5 points per dollar spent on prepaid hotels booked with Amex Travel

- 1 point per dollar spent on all other purchases

The [applyLink pid=”221211836″ overridetext=”Sapphire Reserve”] offers a broader range of bonus categories, including travel purchases of airfare, hotels and dining, and earns:

- 10 points per dollar spent on Peloton equipment and accessory purchases of $150 or more (through Dec. 31, 2027), with a maximum of 50,000 points

- 8 points per dollar spent on all Chase Travel purchases

- 5 points per dollar spent on Lyft rides (through Sept. 30, 2027)

- 4 points per dollar spent on flights and hotel purchases made directly with the merchant

- 3 points per dollar spent on dining purchases

- 1 point per dollar spent on all other purchases

While the Amex Platinum slightly pulls ahead for airfare booked directly with airlines (as it provides a terrific 10% return based on TPG’s June 2025 valuations), the Chase Sapphire Reserve comes out in front in other areas by giving more bonus points on all Chase Travel bookings. Additionally, the Sapphire Reserve has more bonus categories for earning, such as hotels and dining.

Winner: Sapphire Reserve. This card is the best for earning thanks to its favorable rates on Chase Travel bookings, hotels and dining purchases that help you earn more points in the long term.

Related: Best reward credit cards

Redeeming points on the Amex Platinum vs. Sapphire Reserve

With Chase Ultimate Rewards and Amex Membership Rewards points worth a very comparable 2.05 and 2 cents apiece in TPG’s June 2025 valuations, it’s worth looking at their different redemption partners to decide which currency best suits your needs.

Let’s start with the [applyLink pid=”221211836″ overridetext=”Sapphire Reserve”]. In addition to its 14 airline and hotel transfer partners, existing Sapphire Reserve customers get a 50% bonus when redeeming points for travel directly through Chase Travel until Oct. 26, 2027. This gives you an absolute minimum redemption value of 1.5 cents per point. You can book a seat on any flight that’s for sale, even if there isn’t award space available.

Starting June 23, existing and new Sapphire Reserve cardholders will get access to Points Boost, a new way to redeem up to 2 points per dollar spent with select airlines and top-booked hotels through Chase Travel. Points earned before Oct. 26 will automatically get the best offer available, whether that’s the Points Boost rate or the former standard 1.5 cents per point, until Oct. 26, 2027.

If you opt to use your Amex points directly through American Express Travel, you won’t get nearly the value you do through Chase. Flight bookings are a flat 1 cent per point, while hotel reservations clock in at just 0.7 cents apiece. However, the [applyLink pid=”22504813″ overridetext=”Amex Platinum”] has 18 airline and three hotel transfer partners, seven more than Chase.

Points earned from the Amex Platinum and the Sapphire Reserve can be redeemed for nontravel redemptions such as cash back, statement credits and gift cards, but these redemptions generally yield poor value.

Winner: Sapphire Reserve. The card has a higher straight-up redemption value for travel.

Transferring points on the Amex Platinum vs. Sapphire Reserve

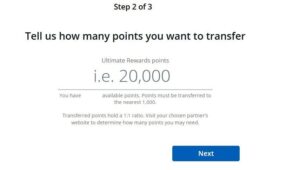

You’ll almost always get better value whenever transferring your points to airline and hotel loyalty programs. All Chase partner transfers are at a 1:1 ratio, and most of them are instant. Ultimate Rewards points are especially useful because they can be transferred to World of Hyatt, where you can book an award night for as low as 3,500 points per night.

On the airline side, popular transfer partners include United MileagePlus, Southwest Rapid Rewards, British Airways Club, Virgin Atlantic Flying Club and Air France-KLM Flying Blue, though the last three also partner with Amex Membership Rewards.

The same holds true for Air Canada Aeroplan, though if you also hold the [applyLink pid=”8103″ overridetext=”Aeroplan® Credit Card”] (see [termsConditions pid=”8103″ overridetext=”rates and fees”]), you can enjoy a 10% bonus on certain transfers from Chase Ultimate Rewards to your Aeroplan account.

Meanwhile, Amex Membership Rewards has an amazing 21 transfer partners, but not all are worthwhile. Some transfer ratios are below 1:1, and some transfer times are longer, which can be risky in terms of award space disappearing while you wait.

As someone who has both the [applyLink pid=”22504813″ overridetext=”Amex Platinum”] and the [applyLink pid=”221211836″ overridetext=”Sapphire Reserve”], I prefer transferring my points to programs like ANA Mileage Club, Air Canada Aeroplan and British Airways Club. Recently, I transferred 50,000 points from my Sapphire Reserve to Aeroplan to book a multicity stopover ticket in business class throughout Europe for my family. The cost would’ve been well over $2,000 if I paid cash for the flights due to higher summer pricing.

Related: A complete list of transfer bonuses over the past decade — which issuer is the most generous?

Winner: Tie. Although the Sapphire Reserve has better transfer ratios, the Amex Platinum has more partners, including some not found with other issuers.

Should I get the Amex Platinum or Sapphire Reserve?

Both cards offer their fair share of perks, with the [applyLink pid=”22504813″ overridetext=”Amex Platinum”] offering access to a wider network of lounges worldwide and statement credits suited for travel and an upscale lifestyle. With the [applyLink pid=”221211836″ overridetext=”Sapphire Reserve”]’s recent refresh, the card not only beats its longtime rival in earning rates but also in statement credits, which offer better value and are better suited for the avid luxury traveler. For many, the Sapphire Reserve will be the better option, unless you aren’t eligible for its welcome offer.

Bottom line

The Sapphire Reserve is a straightforward premium credit card with an impressive list of statement credits and perks that feel less like a “coupon book” to me than the Amex Platinum. The card offers comprehensive earning rates for airfare, hotels and dining, something missing on the Amex Platinum.

However, the Amex Platinum is better suited for those who can make proper use of the card’s statement credits and are looking for far greater lounge access. With the Sapphire Reserve challenging the Amex Platinum, I don’t expect American Express to simply sit back and not hit back with changes of its own.

To learn more, read our full reviews of the Sapphire Reserve and the Amex Platinum.

Apply here: [applyLink pid=”22504813″ overridetext=”The Platinum Card from American Express”]

Apply here: [applyLink pid=”221211836″ overridetext=”Chase Sapphire Reserve”]

For rates and fees of the Amex Platinum, click [termsConditions pid=”22504813″ overridetext=”here”].