This post was originally published on this site

Hyatt offers its loyal travelers a unique advantage over the other major hotel chains when it comes to earning points.

Unlike other big hotel brands like Hilton, Marriott and IHG, which have transfer partnerships with programs like Chase Ultimate Rewards and American Express Membership Rewards, Hyatt is the only one that generally presents solid transfer values.

Given how popular the World of Hyatt program is, many people wonder whether it’s better to earn Chase Ultimate Rewards points with the intention of transferring them to Hyatt or simply sticking to the World of Hyatt Credit Card (see rates and fees).

The World of Hyatt Credit Card

World of Hyatt offers two cobranded credit cards from Chase: the World of Hyatt Credit Card and the World of Hyatt Business Credit Card (see rates and fees).

Let’s review some of the key details about the personal card.

- Welcome offer: Earn two free nights after spending $4,000 on purchases in the first three months from account opening. Plus, earn 25,000 bonus points after spending $12,000 on purchases in the first six months from account opening. In total, this welcome offer is worth up to $1,037 based on TPG’s July 2025 valuations.

- Annual fee: $95.

- Earnings rate: Earn 4 points per dollar spent at Hyatt hotels; 2 points per dollar spent on airfare purchased directly with the airlines, restaurants, local transit and commuting (including ride-hailing services) and fitness club/gym memberships; and 1 point per dollar spent on all other purchases.

- Notable card benefits: Receive a free Category 1-4 free night certificate each year on your account anniversary and complimentary Hyatt Discoverist status, and receive five elite night credits each year, plus earn two additional qualifying nights for every $5,000 spent on the card.

For more details, read our full reviews of the World of Hyatt credit card and the World of Hyatt business credit card.

Earning potential and redemptions

Let’s start with an obvious disadvantage of sticking solely to the World of Hyatt credit card: You’re giving up access to all of Chase’s other transfer partners, including United Airlines, British Airways and Singapore Airlines.

The flexibility of these programs drives much of the value of Chase Ultimate Rewards points, which is why TPG’s July 2025 valuations peg them at 2.05 cents each compared to just 1.7 cents each for Hyatt.

Unless you’re sticking solely to road trips, you’ll need a way to travel to whatever Hyatt property you’re staying in, and Chase Ultimate Rewards points are one of the best options for getting you there.

This flexibility is further enhanced by cards like the Chase Sapphire Reserve® (see rates and fees), which offers redemption rates of up to 2 cents per points when you redeem your points through Chase Travel℠ with the new Points Boost feature.

Hyatt points, on the other hand, can only be redeemed for stays and upgrades at Hyatt hotels.

Now let’s turn our attention to bonus categories and welcome offers and see how the World of Hyatt card stacks up against the three most popular Ultimate Rewards-earning cards:

| Card | Chase Sapphire Reserve | Chase Sapphire Preferred® Card (see rates and fees) | Ink Business Preferred® Credit Card (see rates and fees) | World of Hyatt Credit Card |

|---|---|---|---|---|

| Annual fee | $795 | $95 | $95 | $95 |

| Welcome offer | Earn 100,000 bonus points plus a $500 Chase Travel credit after spending $5,000 on purchases in the first three months of account opening.

It’s important to note that the $500 Chase Travel credit terms state: The promotional credit is valid for a one-time use only, if you apply the promotional credit to a transaction less than $500, you will forfeit the remaining balance. |

Earn 75,000 bonus points after spending $5,000 on purchases in the first three months of account opening. | Earn 90,000 bonus points after spending $8,000 on eligible purchases in the first three months of account opening.

|

Earn two free nights after spending $4,000 on purchases in the first three months from account opening. Plus, earn 25,000 bonus points after spending $12,000 on purchases in the first six months from account opening. |

| Earning rates |

Purchases that qualify for the annual $300 travel credit will not earn points |

|

|

|

At this point, you’ll have to take a hard look at your own spending patterns to see which card comes out ahead. Sure, the World of Hyatt card earns the most points for Hyatt purchases, but if you’re frequently booking award stays, that category bonus might not help you that much.

Plus, earning more points isn’t always the most important thing, as Hyatt points are less flexible (and therefore less valuable) than Chase Ultimate Rewards points.

If you’re trying to decide between the Chase Sapphire Reserve and the World of Hyatt card, the Sapphire Reserve has a clear edge in airfare booked directly and dining purchases.

However, the cards share the same earning rate on Hyatt hotel purchases, but the points earned on the Sapphire Reserve are worth slightly more. Hyatt’s saving grace is the unique bonus category for fitness clubs and gym memberships.

Related: The power of the Chase Trifecta: Sapphire Reserve, Ink Preferred and Freedom Unlimited

Balancing perks and annual fees

Of course, welcome bonuses and bonus categories are only one component of picking the right credit card. Finding the most perks for the lowest annual fee is another important consideration.

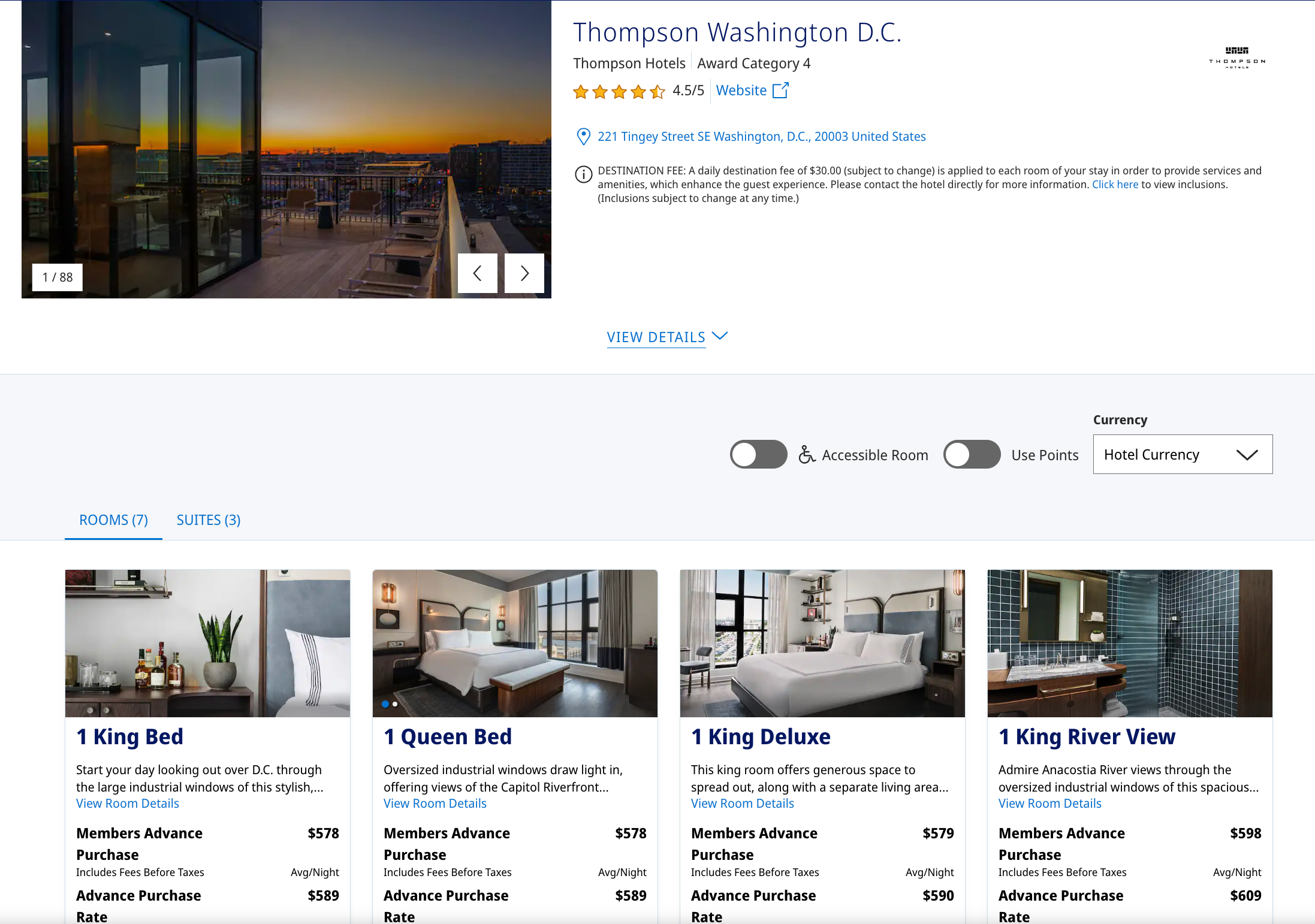

The World of Hyatt card offers a free night certificate each year on your account anniversary that’s valid at any Category 1-4 hotel. You can really get outsize value if you time these redemptions well, such as the Category 4 Thompson Washington, D.C., which goes for almost $600 per night during peak season dates.

You’ll also enjoy complimentary Hyatt Discoverist status, which can add a few hundred dollars of value to your annual travels through perks like late checkout and bonus points. However, the perks of this card are limited to Hyatt stays.

If you want a card that will enhance your travel at the airport, hotels, when you’re renting a car and more, you’ll want a card like the Chase Sapphire Reserve or Sapphire Preferred instead.

For example, even occasional travelers will get more value out of the Reserve’s Priority Pass Select membership and concierge service than they will out of the World of Hyatt card’s Hyatt Discoverist status.

Plus, you can even use your $300 annual travel credit from the Sapphire Reserve to cover expenses at a Hyatt property.

Related: How much do you need to break even points with the Chase Sapphire Reserve?

The case for getting more than 1 card

At the end of the day, it’s possible for many Hyatt loyalists to hold a Chase Sapphire card (or both) and the World of Hyatt card to get the best of both worlds. The biggest caveat is that all the cards mentioned in this post are restricted by Chase’s 5/24 rule, meaning you’ll be automatically rejected if you’ve opened five or more cards in the last 24 months.

Account for the opportunity cost of using up your 5/24 slots on these applications. It’s also important to note that Chase’s new Sapphire card welcome bonus eligibility rules no longer allow one per 48 months.

However, if you are near 5/24 and can only get one card, I recommend going the Sapphire route because it provides far more flexibility, especially if you are not a Hyatt loyalist and want other hotel transfer options.

Bottom line

Cobranded airline and hotel cards have a tough time measuring up against transferable points cards that offer a better return and more benefits, but there’s a compelling case to be made for the World of Hyatt card. At the very least, the free night certificate is enough to negate the annual fee. Plus, if you frequently find yourself paying for Hyatt stays, those 4 points per dollar spent will add up quickly.

If you prefer more flexibility in how you can redeem your points, consider an Ultimate Rewards-earning Chase card that’ll let you take advantage of several transfer partners. If you’re somewhere in the middle and want the best of both worlds, you can also apply for the World of Hyatt card and an Ultimate Rewards-earning card — just make sure you’re under Chase’s 5/24 rule when you apply.

Apply here: World of Hyatt Credit Card

Apply here: World of Hyatt Business Credit Card

Apply here: Chase Sapphire Reserve

Apply here: Chase Sapphire Preferred

Apply here: Ink Business Preferred

Related: How to calculate 5/24 standing

Editorial disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.